Private Equity

Private equity, with its patient and long-term perspective, is the investment of equity capital in private companies. In a typical private equity deal, an investor buys a stake in a private company to increase its value over time. This approach involves active ownership and aims to increase the value of the stake through operational expertise and a close working relationship with the management team. Private equity firms typically hold investments for four to seven years before selling their stake, providing a sense of stability and reliability in the investment strategy.

The ‘100 Days Plan’ is not just a plan; it’s a strategic and urgent component of private equity that cannot be overstated. It emphasizes the importance of immediate action and strategic planning, and its execution can significantly impact the success of a private equity venture. This plan is not to be taken lightly, as it can make or break the early stages of a private equity investment.

The Strategic Approach of Private Equity

Active ownership in private equity is more than just a term; it’s a hands-on approach that involves PE managers working with company teams to enhance the business’s value through various operational improvements. This approach reassures investors about the value creation process in private equity, instilling confidence in the strategy.

Disciplines of Top Private-Equity Firms

Define an Investment Thesis

- Have a three- to five-year plan

- Stress two or three key success levers

- Focus on growth, not just cost reductions

Do not Measure Too Much

- Prune to essential metrics

- Focus on cash and value, not earnings

- Use the Operating Metrics for each business

- Link incentives to unit performance

Work the Balance Sheet

- Redeploy or eliminate unproductive capital—both fixed assets and working capital

- Treat equity capital as scarce

- Use debt to gain leverage and focus, but match risk with return

Make Shareholders the Center of Value Creation

- Focus on optimizing each business

- Do not hesitate to sell when the price is right

- Act as unsentimental owners

- Get involved in the hiring and firing decisions in portfolio companies

- Appoint a senior person to be the contact between the corporate center and a business

Objective

Value creation levers are essential in private equity. These levers involve strategies to increase the valuation of portfolio companies and generate better returns in a specified period. Our expertise in guiding companies with focused metrics enables value creation. We prioritize cash generation. Commercial excellence helps drive revenue growth with existing customers. Pricing and service portfolios offer significant opportunities to enhance margins and drive revenue growth. We are looking forward to an operating partner role.

What are the Challenges in the Private Equity Sector When Targeting Companies for Investment?

- Is the initial understanding of the business model accurate about the target company?

- What factors might make this company vulnerable in the future?

- Is the business plan in our investment base case achievable within our investment horizon?

- Do we have adequate comfort in our assumption of projected revenue growth, margin expansion, cost reduction, cash conversion, and reinvestment requirements?

- Moreover, do we have a reputable management team to deliver this business plan?

- Do we have any reason to suspect that the company’s financial statements might not reflect reality, for example, due to aggressive accounting choices, manipulation, or fraud?

- Do we have any concerns about the business that might give rise to reputational risk?

- Are we completely clear about what assets are included in the deal's perimeter (e.g., brands, trademarks, patents, proprietary technology, tangible assets, and human capital)? Are these assets sufficiently unencumbered to ensure a smooth transfer of ownership?

- What current and future liabilities of the company are we buying? Do we understand the expected impact of these liabilities on the projected cash flows in the business plan?

- How will the change of control impact the company and its business model? What material agreements might need to be renegotiated?

- Are we confident that the power shift will not cause the company’s business model to dissipate (for example, due to potential losses of dominant customers or suppliers)?

- Given what we know about the market and the company post-diligence, does our investment thesis still stack up?

- Is the company likely to be a desirable investment target at exit?

What Do We Offer?

Can we create these infographics? I forget this one in my infographics package.

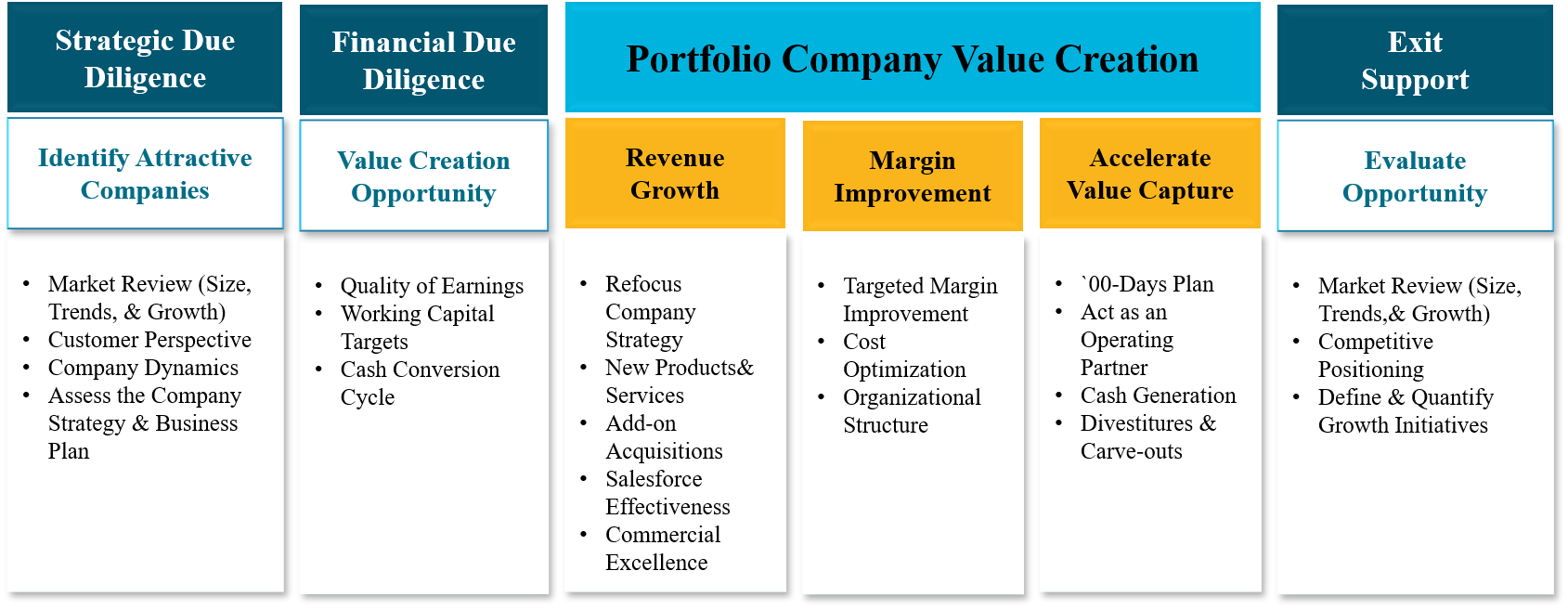

| Strategic Due Diligence | Financial Due Diligence | Portfolio Company Value Creation | Exit Support | ||

|---|---|---|---|---|---|

| Identify Attractive Companies | And Value Creation | Revenue Growth | Margin Improvement | Accelerate Value Capture | Evaluate Opportunity |

| Market Review (Size, Trends & Growth) | Quality of Earnings | Refocus Company Strategy | Targeted Margin Improvement | 100-day plan | Market Review (Size, Trends & Growth) |

| Customer Perspective | Working Capital targets | New Products & Services, add-on Acquisitions | Cost Optimization | Act as Operating Partner | Competitive Positioning & Customer Perspective |

| Company Dynamics | Cash Conversion Cycle | Salesforce Effectiveness | Organizational Structure | Cash Generation | Define & Quantify Growth Initiatives |

| Asses the Company Strategy & Business Plan | Commercial Excellence | Divestitures & Carve-outs |

Financial Due Diligence (FDD)

- Quality and visibility of earnings. Breakdown of sales into organic and non-organic growth. Breakdown of sales and profitability by product, customer account, distribution channel, and geography.

- Detailed analysis of fixed vs. variable costs and unit economics.

- Correlation of revenue and earnings to the economic cycle. Analysis of non-recurring items, foreign currency effect, and hedging.

- The balance sheet review includes net debt, accruals, provisions, and trapped cash—a detailed review of contingent liabilities, employee benefit provisions, and off-balance sheet items.

- Normalized earnings, target working capital, and sustainable levels of maintenance and expansion CAPEX.

- Detailed analysis of business plan projection and key sensitivities. A thorough examination of historical and projected cash flow profiles.

The initial investment thesis should frame the direction and goals of due diligence. The thesis should consist of an initial hypothesis and focused analyses designed to prove or disprove the hypothesis. The investment thesis is essential for financial due diligence as it will typically highlight the critical areas of focus and analyses required.

Remember: It’s wise to be vigilant during financial due diligence. Aggressive accounting, earnings manipulations, and fraud are not uncommon.

- Setting working capital targets. Many acquisitions must recognize their value to meet their working capital goals. Working capital can be a complex area in terms of due diligence and valuation. Working capital is highly variable, often showing seasonal and cyclical trends that must be considered when setting appropriate targets. Determine the quality of working capital.

- Probability that accounts receivable will be converted into cash.

- Saleability of inventory, particularly inventory beyond a certain age or at a late stage in the product life cycle.

- Ability to control the timing of cash conversions and accounts payable disbursements.

Conventional wisdom says that a rising economy is good and a declining economy is terrible. While this is generally true for revenue and perhaps even margins, it is only sometimes straightforward for working capital. Economic growth can provide an opportunity to impact working capital, although the impact is gradual and positive.

After finalizing a deal, working capital can become a point of contention or present opportunities. Unexpected market fluctuations or failure to meet targets can increase leverage and financing costs, requiring a balance sheet restructuring. Conversely, acquiring companies can decrease working capital needs. Companies with lower working capital requirements tend to grow more efficiently.

- Interest rates and customer and supplier cash positions. When setting working capital targets, consider

potential changes in customer and vendor cash positions amidst economic influences. - Industry dynamics. A company’s competitive position can impact its working capital needs. Larger companies have more leverage with suppliers and customers, while weaker businesses may need to concede on payment terms and have less negotiating power.

- Post-close improvements. The baseline working capital balance is a starting point in estimating future targets. Operational improvements can change a company’s future working capital needs. Changes in accounts payable can be made quickly but are challenging to sustain. Inventory and accounts receivable reductions can be sustained long-term but require more time or effort.

- Inventory improvements. When assessing areas for improvement in inventory planning, a recommended starting point is to adjust the company’s sales and operations planning (S&OP) process to include frequency, participation, inputs, and outputs.

- Value Creation Plan. Private equity firms now incorporate operational involvement as a core part of their business, extending the due diligence process to include developing a post-acquisition plan. The decision to acquire a company and develop a strategy for post-close value creation go hand in hand. Value creation plans, often called ‘100-day plans,’ traditionally address governance, financial controls, and, if needed, senior team changes. Firms focusing on restructuring or turnaround make high-level operational decisions within this time frame.

How Can We Help You Create Value?

Operating Partner Role

- What do you do with the business once you have invested?

- How do you create value?

- What do you do to make that company much more efficient?

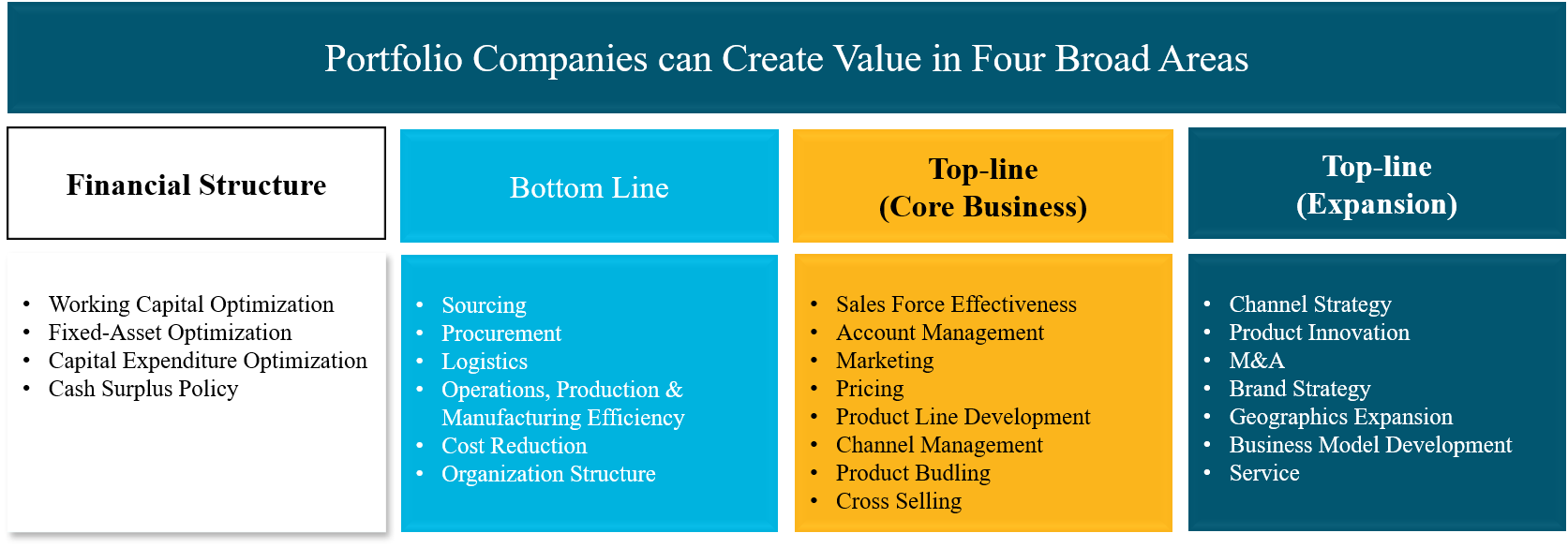

Private equity investors aim to create lasting value in their portfolio companies by focusing on revenue growth, margin improvement, overhead reduction, and capital efficiency. The critical value drivers determine the investment’s success.

Cash Generation measures the ultimate priority and outcome in a specified period.

To accelerate post-acquisition implementation, it’s crucial to translate each value-creation lever into specific steps reflecting a unique approach for each company’s strategy. Companies must prioritize, address pressing needs, and focus efforts where quick gains are attainable within the 5-year investment horizon.

Businesses may focus on organic revenue growth or increase sales through acquisitions. Some may improve supply chain practices, while others prioritize addressing customer turnover and increasing sales effectiveness. Private equity owners have similar goals, but each company has a unique plan.

Active Ownership: Value Creation Strategy

A value creation plan is a roadmap to the company’s future. It delineates a set of initiatives a portfolio company must pursue to realize its strategic agenda and fulfill its potential under private equity ownership. A typical Value Creation Plan encourages the company to adopt a systematic approach and carry out the following actions over a 5-year horizon.

- Establish a culture of performance and accountability to challenge the status quo.

- Overinvest in early wins in the first 100 days of ownership.

- Strengthen existing capabilities and deliver operational excellence.

- Pursue profitable growth through new products or markets.

- Consolidate success and position the business for exit.

To design a Value Creation Plan in practice, engage in a comprehensive planning process to be prepared to take action immediately after the deal is finalized. This involves creating a detailed investment base case quantifying planned cost savings and revenue enhancements for the holding period. Analyze final due diligence reports to identify current inefficiencies and areas of value leakage. Work with the management team to assess the company’s capabilities and resources for executing the plan post-acquisition. Establish a shared vision of critical priorities, implementation steps, milestones, and KPIs.

During the Value Creation Plan meeting, investors and management can build rapport and set expectations. In leveraged acquisitions, the focus should be on reducing risk post-closing. Management should prioritize cash-generating strategies to make a financial cushion, repay debt, and fuel business growth.

100 Days Plan

The 100-day plan is the first step in making the Value Creation Plan execution a reality. When the transaction reaches its maximum momentum, and the company is most receptive to implementing changes, the most effective 100-day Plans focus on producing quantifiable improvements in EBITDA through a limited set of actions aimed at capturing near-term value through selective optimization and redesign of the portfolio company.

- Communication: Uncertainties are addressed by communication with employees, significant customers, and suppliers.

- Employees: The CEO needs to implement planned changes decisively during the first 100 days. What does the leadership structure look like just below the senior management team? Existing and newly appointed line managers need to decide on the optimal structure for their business units so that employees across the board can be informed.

- Reporting: How strong are reporting capabilities at present? Does the finance team use business analytics to produce insightful analyses of the company’s operations? Finally, does the finance department have adequate resources?

- Objectives, milestones, and KPIs: The company should take steps toward becoming a best-in-class organization in terms of operational performance and focus on the core business before adding new capabilities. In addition, most companies will need to be selectively upgraded and retooled to support future growth. Where is the low-hanging fruit? What creates the most impact and produces early wins? Typical initiatives in the first few months under PE ownership include optimization of the working capital, IT upgrade, improvements in the supply chain and purchasing arrangements, and redeployment of spare capacity and other unproductive capital assets.

- Program office, 100 Days Plan: If a 100-day plan is extensive, setting up a Program Office responsible for coordinating and controlling the implementation might make sense. The management team can leverage the Program Office to ensure that tools are in place to measure progress, capture value, and provide frequent updates to all stakeholders, including investors, employees, and senior managers.

- Incentivize/ Reward System: Demanding and stressful work needs to be rewarded. An effective award system, on-time bonuses, or additional equity in the company are linked to the successful execution of the plan and the delivery of quantifiable EBITDA improvements.

Governance and Reporting

What is the typical structure of a private equity board? How do board members interact with management teams post-acquisition? What do private equity boards need to measure to keep on top of their investments?

- Board Composition: Private equity boards tend to be minor, averaging 5-7 board members. A controlling investor typically takes at least three board seats, with two seats allocated to the company’s Chairman and CEO. The business's CFO attends most board meetings by invitation without being a formal board member.

- Management Reporting: “What you measure is what you get.” What the board members need. First, they must track the company’s performance against the investment base case and the Value Creation Plan. Second, they require timely and accurate data about past performance against budget and forecast data for the future. Third, they must be aware of critical risk areas and evaluate whether sufficient controls and mitigation mechanisms exist. Finally, they should be presented with an integrated view of business performance across the organization's main pillars, including operations, sales and marketing, and human resources.

Exit Plan

First, what is the current state of the portfolio business? Is it exit-ready? Second, do the market multiples look attractive in the context of current history? Third, is this the optimal time to return cash to LPs from the sponsor’s point of view?

When you first acquire a portfolio company, it may not look beautiful to potential buyers. It could be amid a complex reorganization, an unstable workforce, limited growth, and unpredictable cash flow. This is why most owners prefer to keep the initial phases of value creation hidden from prospective buyers. Once a significant portion of the business plan is implemented and the company can consistently show positive trends in revenue growth, profits, and cash flow, the portfolio company becomes a desirable asset. This is especially true if a competent and experienced management team leads it.

Is it reasonable to wait another 6-12 months before selling the business? What trade-off can be expected between the money multiple and the IRR of this investment? Remember that the longer the holding period, the higher the exit price needs to be to achieve your target return.

Market environment. During periods of economic uncertainty and when publicly listed companies are trading at historical lows, it is not advisable to try to find a reasonable buyer who will pay a fair price for even the most attractive and resilient private equity asset. When the market is challenging, why struggle against the odds? Instead, why not try to time the economic cycle?

In simpler terms, private equity investors can sell more investments and get higher returns when market conditions are favorable. Some investors also charge higher prices for investments that have performed well during their ownership and have shown strong leadership in market share or have a competitive cost advantage at the time of sale.

Sponsor consideration. Many private equity funds base their investment decisions on a five-year business plan, and they assess potential returns when planning for an exit within three to five years. In practice, the assumed investment timeline generally aligns with real-world outcomes.

Frequently Asked Questions

While private equity as an industry still has a reputation for relying on financial engineering when investing in a company, the last decade has seen firms become much more focused on ways to grow their portfolio companies through operational investments.

As financial sponsors increasingly focus on this strategy, the role of the operating partner has become much more prevalent at firms large and small. While most senior executives at firms are transactional, operating partners are typically proven business leaders whose focus is accelerating the value creation of portfolio companies and playing an active role throughout the lifetime of a given investment.

Operating partners integrate fully within a platform investment, often taking the active chairperson role. They spend a significant amount of time on-site, work closely with management teams, give high-level guidance, and help identify and implement growth strategies involved in a company’s day-to-day operations.

Active Ownership-Value Creation Strategy

A value Creation Plan is a roadmap to the company’s future. It delineates a set of initiatives a portfolio company must pursue to realize its strategic agenda and fulfill its potential under private equity ownership. A typical value creation plan encourages the company to adopt a systematic approach and carry out the actions over a 5-year horizon, including Establishing a culture of performance and accountability to challenge the status quo, Overinvest in early wins in the first 100 days of ownership, Strengthen existing capabilities and deliver operational excellence, Pursue profitable growth through new products or markets, Consolidate success and position the business for exit.

Suggested additional actions over a 5-year horizon period: Embrace digital tools & technology to enhance its operational agility, Optimize Product Pricing, and Enhance the company’s ESG Capabilities

Private Equity firms have increasingly turned to Operating Partners to drive value in their portfolio companies. The presence of Operating Partners in PE firms has become a vital component of value creation. Operating partners are former executives from similar industries with expertise in operations, financial reporting, strategy development, and implementation. Private equity funds are suitable, of course, to select only candidates who have the complex skills needed to create value.

The typical career path for an operating partner in private equity involves several key steps:

- Extensive industry experience: Operating partners in private equity firms usually have deep prior experience, often 10-20 years, working in operational roles within companies in the private equity firm’s target industries. This could include roles like COO, plant manager, supply chain executive, etc.

- Demonstrated operational expertise: Successful operating partners have a proven track record of driving operational improvements, increasing efficiency, and growing businesses. They bring specialized knowledge in operations, manufacturing, supply chain management, etc.

- Transition to advisory/consulting: Many operating partners start by serving as consultants or advisors to private equity firms, helping evaluate potential acquisition targets and develop value-creation plans.

- Joining a private equity firm: After demonstrating their operational capabilities as an external advisor, operating partners are often brought in-house to private equity firms to take on more formal roles supporting portfolio companies.

- Managing portfolio company operations: As an operating partner, the focus shifts to working directly with the leadership teams of private equity portfolio companies. Operating partners leverage their industry knowledge to drive operational improvements and unlock value.

- Contributing to firm strategy: Experienced operating partners often gain increased influence, advising the private equity firm on overall investment strategy, target industries, and value creation approaches. Combining deep operational expertise and private equity experience makes operating partners a valuable resource for bridging the gap between financial engineering and hands-on business transformation within private equity portfolio companies.

Primary Responsibilities and Duties: Working alongside the CEO and management team of the portfolio company, You Analyze business challenges to identify areas for improvement, Develop plans that foster growth and enhance efficiency, and engage in strategies aimed at increasing profits and enhancing cash flow.

Most Common drivers of value creation, #1. Achieve operational and financial efficiency. Below is a list of the value-accretive activities that will positively impact the company’s bottom line and cash generation by monitoring its operating metrics—#2. Optimize existing customer value proposition. The activities below aim to focus on the company’s core competencies to maximize the sustainability and profitability of the current product portfolio; finally, let the company spread its wings by expanding into new markets or pursuing add-ons (#3) only once #1 and #2 are achieved, which typically coincide with the beginning of year three onwards in most business plans.