Fundraising Advisory

Securing the funding facility is not just important; it’s essential for the success of any business. The fuel drives companies forward and allows them to reach their full potential. While using debt for expansion can be cost-effective, navigating stricter lending requirements is crucial. We specialize in analyzing opportunities for business growth, managing risk, and assessing creditworthiness, which significantly increases your chances of getting that essential loan approval. Securing this funding is our top priority, and we urge you to prioritize your financial planning accordingly.

Cash Flow and Working Capital

Working Capital to address liquidity

Fixed Capital / Term Loan (Mid to Long-term)

Risk Mitigation

Credit Rating and Credit Worthiness

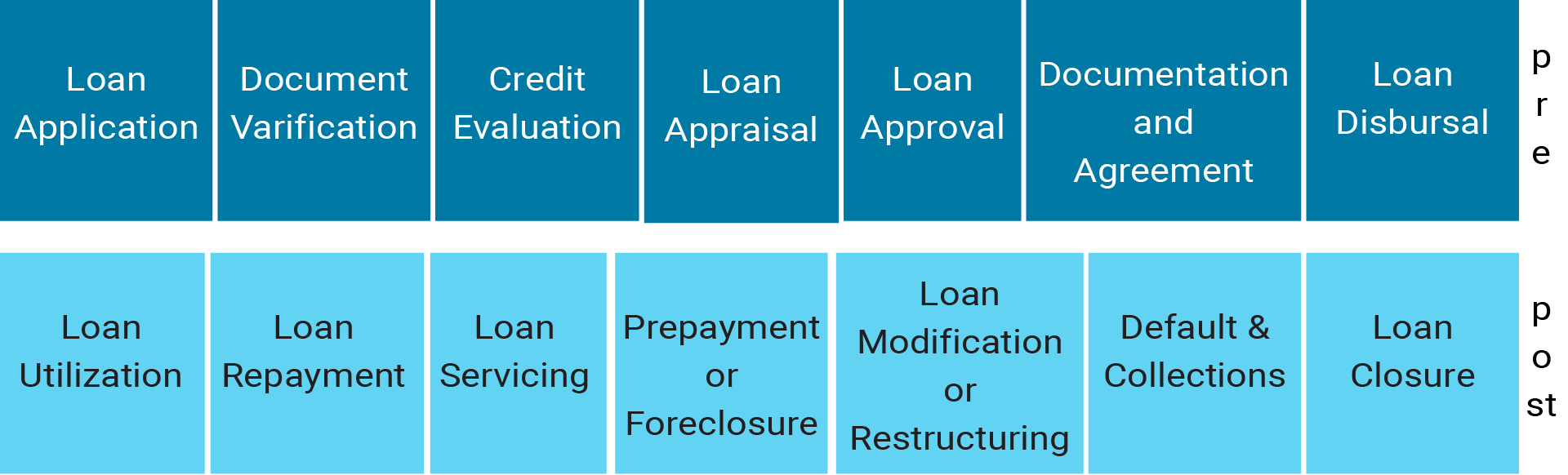

Bank Relationship Competence – Post Disbursal

Banks and lenders are vital stakeholders in the businesses they lend to. We help you go beyond compliance reporting by facilitating proactive communication, providing regular updates on business development, and highlighting progress on specific factors considered in bank proposals. This helps in securing facility renewals and obtaining urgent funds when needed.

Objective

Fintelligence Consultants takes a cautious approach to credit requirements. Businesses must have a stable funding facility, whether in whole or part. Meeting the banks’ requirements is essential, as the NPA crisis has heightened and complicated the lending criteria. Fintelligence Consultants helps you pave the way for success by addressing the crucial needs of lenders. A robust Business Plan addressing the lenders’ perspective encompasses your business strategy and growth aspirations.

How Can We Help?

- A robust business plan is crucial to ensure creditworthiness and credit monitoring. This plan should cover business strategy, growth objectives, and preparations for medium- term business expansion.

- Financial projections indicate immediate future credit requirements. Financial projections must cover the growth ambition and achievable prospectus, considering the external environment, such as industry cycle, economic activity, competition, and internal capabilities, to execute the growth plan and possible alternate strategy in case of headwinds and intense competition in your sector.

- Business growth ensures revenue and profitability and generates positive cash flow. Lenders evaluate the potential for debt repayment and interest coverage over the loan period based on free cash flow, which reflects the capacity to repay.

- Strengthening the balance sheet is essential before seeking bank funding. Genuine efforts and effective execution contribute to this. The Working Capital Gap, Debt Service Ratio, and Promoters' contribution through retained earnings or equity can address funding gaps.

- Additionally, preparing a credit monitoring application (CMA) in the bank's specified format and creating a company presentation or "Pitch" to explain the current situation, strategy, and medium-term plan to achieve business growth is essential.

- The “Pitch” facilitates presentation and discussion with the lenders. This is the stage at which you can read the lender's mind well and follow observations to meet any gaps if indicated.

What is Working Capital?

Working capital refers to the funds needed for current assets to maintain uninterrupted business operations. Inadequate financing can lead to financial trouble, while having excess working capital may result in delayed payments. Cash credit/bank overdraft is a standard and cost-effective financing option. Fund-based and non-fund-based bank credit options are also available.

Working capital financing can be done through trade credit, cash credit/bank overdraft, working capital loan, and other modes. It is essential to a finance manager’s responsibilities, requiring consistent attention to ensure smooth business operations.

What CCC? Cash Conversion Cycle, or Cash-to-Cash Cycle, or Operating Cycle?

The operating cycle of any manufacturing activity involves a series of steps, including purchasing raw materials, converting them into finished goods, and selling them to realize cash. The operating cycle duration is the time taken for cash outlay for purchasing raw materials and realizing cash from the sale of finished goods, including the time for accounts receivables to be collected.

The operating cycle consists of four main components:

- The Time taken to acquire raw materials and the average time they are held in inventory.

- Time taken in the conversion process.

- Average period for which finished goods are held in inventory.

- Average collection period of accounts receivables.

The cash-to-cash cycle demonstrates how cash is used to purchase raw materials, produce goods, create receivables, and convert to cash. Working capital refers to the total money involved in this cycle and can be redeployed once the cycle is complete. Therefore, the length of the operating cycle is the sum of the four components mentioned above.

- Current Assets include Accounts Receivable, Inventory (Raw Material, Work in Progress, Finished Goods)

- Current Liabilities include Accounts Payable, Advances from Customers, and other current liabilities.

To manage its working capital effectively, a business needs a higher level of current assets and a longer operating cycle than current liabilities.

What are the Types of Working Capital Loans?

How Does a Bank Approve a Long-Term Borrowing/ Term Loan?

Term loans carry a fixed or variable interest rate and a set maturity date. If the proceeds are used to finance the purchase of an asset, the useful life of that asset can impact the repayment schedule. The loan requires collateral and a rigorous approval process to reduce the risk of default or failure to make payments. As noted above, some lenders may require down payments before they advance the loan.

Types of Term Loans

- Short-term loans: These term loans are usually offered to firms that don't qualify for a line of credit. They generally run less than a year, though they can also refer to a loan of up to 18 months.

- Intermediate-term loans: These loans generally last one to three years and are paid in monthly installments from a company’s cash flow.

- Long-term loans: These loans last anywhere between three to 25 years. They use company assets as collateral and require monthly or quarterly payments from profits or cash flow. It may limit other financial commitments the company may take on, including other debts, dividends, or principals' salaries, and can require an amount of profit set aside expressly for loan repayment.

- A term loan is granted for a fixed term of not less than three years, intended for financing fixed assets acquired with a repayment schedule typically not exceeding eight years. A term loan is a loan granted for capital assets, such as the purchase of land, construction of buildings, purchase of machinery, modernization, renovation, or rationalization of plant, & repayable from out the future earnings of the enterprise, in installments, as per a prearranged schedule.

- I. The purpose of the term loan is to acquire capital assets.

- II. The term loan is an advance that is not repayable on demand but only in installments over the years.

- III. The repayment of a term loan is not out of sale proceeds of the goods & commodities per se, whether given as security or not. The repayment should come from future cash accruals from the unit's activity.

- IV. The security is not the readily saleable goods & commodities but the fixed assets of the units.

Thus, the scope and operation of term loans may differ entirely from those of conventional working capital advances. The Bank’s commitment is for an extended period, and the risk involved is more significant. Risk is inherent in any loan because of the uncertainty of repayment. The longer the duration of the credit, the greater the attendant uncertainty of repayment and, consequently, the greater the risk involved. However, it may be observed that term loans are not as lacking in liquidity as they appear to be.

The repayment of a term loan depends on the future income of the borrowing unit. Hence, the bank’s primary task before granting term loans is to assure itself that the anticipated income from the unit will provide the necessary amount to repay the loan. This will involve a detailed scrutiny of the scheme and its financial, economic, and technical aspects, a projection of future trends of outputs and sales, and estimates of cost, returns, flow of funds, and profits.

What is Bank Credit Monitoring Arrangement (CMA) Data

CMA Data means Credit Monitoring Arrangement data. Per RBI guidelines, CMA data is required for Project Loans, Term Loans, and Working Capital Limits. A company must provide this data to the bank when getting a loan and renewing or enhancing an existing Bank loan every year. CMA Data is a systematic analysis of the borrower’s working capital management, and this statement aims to ensure the effective use of funds.

CMA data generally includes two years of Audited Financials and three future years of Financial Projection of the company, Fund flow statement, Changes in Working Capital report, Ratio analysis, and Maximum Permissible Bank Finance (MPBF) report. The banks rely very much on this report and carefully evaluate CMA data for eligibility for funding. It contains seven statements that help Banker to understand the financial health of the company:

- Provide details about the present limit and the proposed limit. This will show both the borrower's Fund and non-fund-based limits and the usage limit or current balance.

- Operating Statement/Profit and Loss Account Statement: the bank will know the company's performance. It is also helpful to see the earning cycle for paying the expenses.

- Balance sheet: The bank will know the financial position. Is it sound or not? Does the company have assets, or are all its assets in debt? So, studying a balance sheet is a must. CMA Data will have two 2-year Audited and three-year projected balance sheets. Analysts can make a comparative balance sheet to determine the changes in the balance sheet’s position.

- A fund flow statement allows the bank to track the flow of funds. Is the company wasting its funds or using them for growth?

- Changes in working capital report—This report helps understand current assets and liabilities changes. It will also help determine the company's short-term solvency. A company cannot misuse its long-term resources if it has enough money to pay current liabilities.

- Ratio analysis allows the bank to understand the company's position more clearly within a few minutes.

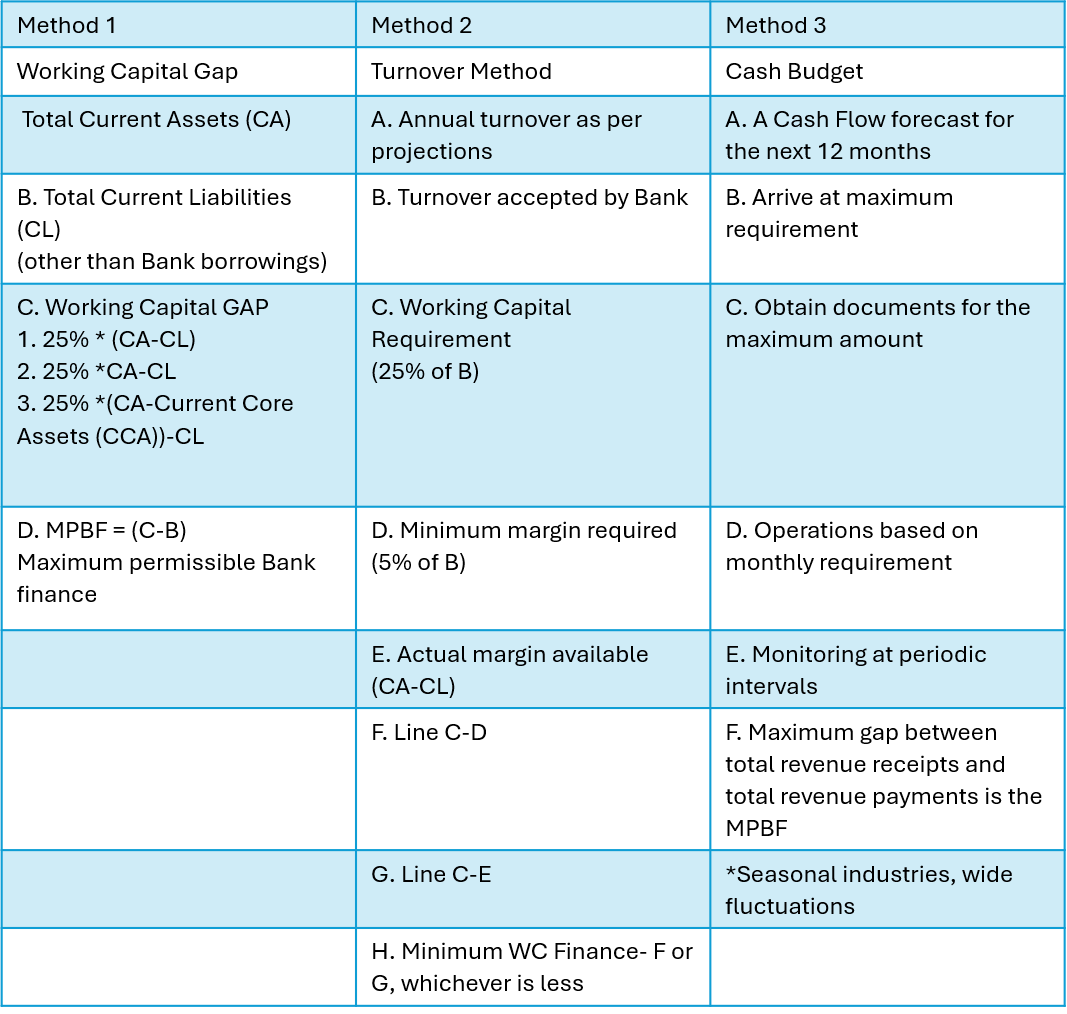

- Banks ask for the maximum permissible bank finance (MPBF) working. That is, the amount the company is looking to borrow from the bank. It should be at most 75% of working capital or 20% of Sales.

Why Do Borrowers Always Feel Banks Ask For More Information?

Basic concepts of CMA data. Credit Monitoring Arrangement (CMA) data is critical for a person dealing with finance in an organization to understand. It is a vital analysis of the current and projected financial statements of a loan applicant by the banker. CMA data is a systematic analysis of the working capital management of a borrower, and the objective of this statement is to ensure that long-term and short-term funds have been used for the given purpose. CMA data contains seven statements, which are as follows.

- Existing & proposed limits: This statement will mention the borrower's present fund and non-fund-based credit limits, usage limits, and history. Along with present fund limits, the borrower's proposed or applied limit will also be mentioned in this statement. This is an essential information document that the borrower and the banker provided.

- Operating statement: The borrower's business plan gives Current Sales, Direct and indirect expenses, and Profit before and after tax, along with sales, costs, and profit position projections for the 3 to 5 years based on the borrower's working capital request. This statement is a scientific analysis of the borrower's current and projected financial and profit-generating capacity.

- Analysis of Balance sheet: The third statement in CMA data is the balance sheet analysis for the current and projected financial years. Balance sheet analysis gives a complete financial position of the borrower and cash-generating capacity during the projected years.

- Comparative statement of Current assets and liabilities: The comparative analysis of current assets and liabilities movement determines the working capital cycle for the projected period and assesses the borrower's capacity to meet their working capital requirements.

- Calculation of MPBF: This significant statement and calculation indicate the Maximum Permissible Bank Finance. Using two lending methods, the MPBF statement calculates the borrower's working capital GAP and permissible finance. MPBF is a significant statement that decides the borrower`s borrowing limit from the bank.

- Fund flow statement: A fund flow statement analysis for the current and projected period is one of the statements in CMA data. The primary objective of this statement is to capture the borrower's fund movement for the given period.

- Ratio analysis: The critical ratios to the banker are based on the CMA data prepared and submitted to the bank for finance. Fundamental key ratios are Gross profit ratio, net profit ratio, current ratio, DP limit, MPBF, Net worth, the ratio of net worth with Liabilities, quick ratio, stock turnover, asset turnover, fixed asset turnover, current asset turnover, working capital turnover, Debt Equity ratio, etc.

- Conclusion: In this article, I tried to give a basic idea of CMA data and its contents. I hope it will be helpful for the readers.

DOCUMENTS/INFORMATION REQUIRED TO PREPARE CMA:

- Past two years Audited Financials

- Provisional Financials for the current year; in the absence of provisional financials, details of the top line will be essential.

- Financial Projections for the next 3-5 years

- Latest Sanction letter (in case of renewal)

- Term Loan Repayment Schedule, if any.

- Details of proposed enhancement (if any) along with the terms and conditions

Why Choose Us?

Business and Financial Plan Expertise

Borrowers Perspective

Lender Perspective

Communication skill

Coaching and Competence Focus

Our unwavering focus on coaching and developing competence underscores our commitment to helping our clients achieve sustainable business results. We believe that meticulous execution and an unyielding dedication to improvement are paramount. We offer comprehensive supportive services to ensure our clients thrive, including personalized business coaching, tailored competency development, hands-on project and process support, adequate tool support, and customized mentoring. We aim to empower our clients to attain and maintain their desired outcomes, ensuring their long-term success and prosperity.

- Bank Monitoring Competence – Post Disbursal Establishing and nurturing strong business relationships with banks and lenders is essential for the success of our business. We are committed to enhancing our competence beyond mere compliance reporting. Our approach involves proactive and transparent communication, providing regular updates on our business development, and sharing detailed progress reports on specific factors considered in bank proposals. We aim to create a positive and lasting impression with our financial partners by adopting this approach. Ultimately, this strategy strengthens our ability to renew existing facilities and enables us to obtain urgent funds when needed temporarily.

- We wish to take key personnel mentoring. We hope what we deliver to clients will be sustainable in the medium to long term. Many times, mentoring key personnel helps keep that momentum. We identify them as super users. Super users are responsible for mastering specific skill sets and internally training others. This is the benchmark practice where the company can internalize the competence building without frequently hiring an external advisor.

How Do We Serve Our Clients?

Frequently Asked Questions

Fundraising consultants guide startup founders and CEOs through raising capital on the best terms from the right investors. The ultimate goals of working with a fundraising consultant are to drive your campaigns to success, build more robust internal fundraising processes, and grow your fundraising capacity over time. This is why small to mid-size nonprofits, in particular, can reap many long-term benefits from professional guidance.

The fintech companies registered as NBFCs who have started lending businesses with the help of new technologies work as aggregators. They leverage the GST-based data to address the short-term (transaction to transaction) funding requirement. They are governed and monitored by the Reserve Bank of India. They enable access to finance.

Funding is a business’s lifeline. It is required to grow the business, invest in equipment and marketing plans, and sometimes hire competent teams and senior people. Growth requires funding, which can weaken an organization if there is no standing facility. A Business plan is a future strategy, and a similar funding plan is crucial.

Fundraising advisory helps organizations prepare their business plans and funding strategies and pitch or present them to banks and investors. Advisors speak the language of lenders and investors, and more importantly, they understand how to interpret the business language and requirements. Advisors help solve the puzzle and ensure lenders and investors listen to the business owner.

Getting started with fundraising advisory is simple. You can contact us by phone or submit the form on our website. Rest assured, we will be available to address your business requirements and provide solutions.

Market volatility, economic challenges, technological disruptions, and, lately, supply chain disruptions have multiplied business risk. Lenders and investors seek to protect their investments and earn returns. The bank NPAs in India have worsened this situation. They look into creditworthiness, credit rating, governance, and risk mitigation while funding. The experienced fundraising consultant understood the market trends and business requirements. Their expertise is converting the business owner’s sales pitch into a strategic plan and presenting lenders and investors with terminology and best practices to address concerns. Business owners’ entrepreneurial approach can get sufficient funding advice.

- If a business faces a consistent funding shortfall and cannot overcome it for a particular period despite internal efforts, seeking expert solutions is the primary indication. Organizations have a culture that prolongs difficult periods by using goodwill, adjusting priorities, and using temporary solutions. You may survive, but the scar of poor processing and ineffective solutions gets built into your culture and jeopardizes the business’s growth. Our experience shows that any accounts receivable outstanding for more than 90 days turn into 180 days. There is a 75% chance that these 180 days outstanding turn into bad debts. Companies invest quite a substantial time and money in generating orders, completing production, and delivering the orders. If they don’t get paid in time and as per terms and conditions, they may go bankrupt. Also, any inventory that ages >180 days turns into absolute inventory!

- Call an advisor for a meeting to discuss your issues and seek advice. Business owners are experienced and rational enough to understand the expert solution’s workability!