Virtual CFO

Outsourcing of Financial Planning and Analysis function

Financial Planning & Analysis (FP&A)

Profit Maximization

Revenue enhancement and Margin Expansion are essential to financial success. Revenue enhancement involves pricing strategies, while Margin expansion involves reducing the COGS ratio, cost optimization, and effective operating leverage. We help drive revenue and establish a margin management framework without compromising service levels.

Cash Flow and Working Capital

Growth Equity and Valuation

Fundraising Advisory

Cross Functional Business and Executive Coaching, Project and Competence

Objective

We offer financial planning and analysis services virtually. Though it is a virtual and part-time service, our objective remains unchanged. Our mission is to inspire value creation and enduring success by guiding companies in enhancing their strategy, management, and finance-related business processes. FP&A is vital in shaping business strategy, crafting a strategic business plan, and steering budgeting and forecasting.

What Challenge(s) do Our Clients Face?

We aim to empower our clients to address various concerns in decision-making while focusing on strategic objectives. We understand the challenges you face and are here to provide strategic solutions that put you in control of your business’s future, such as:

- How can we gain visibility and control to achieve our forecasted revenue and profitability? Are there opportunities to redesign processes and execute our budget efficiently?

- What strategic path should our company take to drive organic growth? Is there still an opportunity in the core business, or should it be moved into adjacent businesses? How can we measure the full potential of the business?

- How difficult is the M&A path? What M&A strategy is suitable for my business?

- What initiatives are needed to achieve strategic objectives? Is there a best practice that can be implemented in the organization?

- Is it possible to take adequate measures towards working capital improvement and stabilize liquidity?

- What is the best way to generate positive cash flow?

- How can a business achieve profitable growth? Does profit maximization hurt customers and service levels?

- What levers can improve profitability considering revenue and cost/expense optimization?

- What is the actual profitability of our business and its product lines? How can we measure customer profitability? Can it be possible to measure and enhance individual customer profitability?

- What measures are required to make our business attractive to investors and lenders? Does it assist in achieving the fundraising objective? What is growth equity, which is used to create business opportunities?

- Does the business plan improve the bank funding facility opportunity? Does it address the bank’s concerns about creditworthiness and credit rating issues and getting assured and quicker approvals?

- How do we establish governance? Does that complement organizational growth and attract lenders and investors? Do we lose control and business decision-making with independent director appointments?

- What is finance excellence? Can there be specific functional excellence?

How Do We Help?

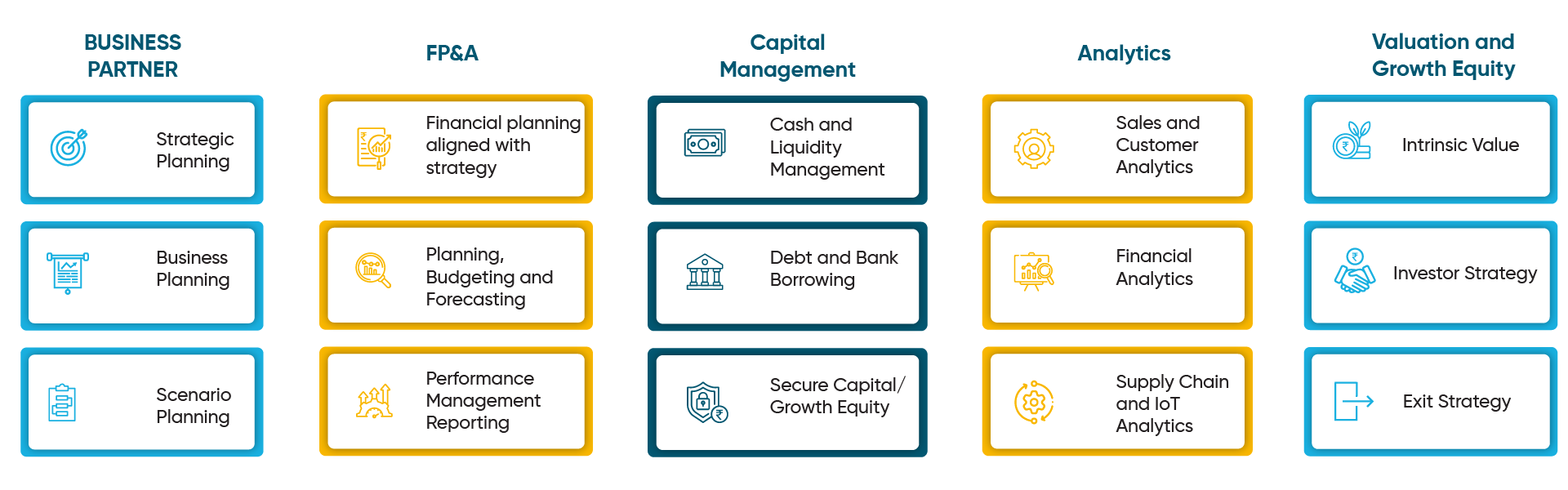

Fintelligence Consultants is your comprehensive business partner in financial planning and analysis. We offer various insights and actionable services intricately aligned with your business strategy. Our services are designed to elevate your performance and create value through meticulous planning and enhanced efficiency. This value creation increases competitiveness and long-term sustainability, instilling optimism about your business’s growth potential.

- Virtual CFO Services focused on Financial Planning and Analysis, including strategic planning, business planning, budgeting, forecasting, and sensitivity analysis.

- Execution involves profit maximization, driving capital efficiency through free cash flow and working capital management, and financial analytics focused on business profitability with insights and actions.

- Measurement and management cover enterprise performance management, Board Management, Reporting, and FP&A team organization.

- Establishing effective governance, improving management execution capabilities.

- Services include bank borrowing advisory, investor readiness/attraction, private equity growth equity, and mezzanine financing.

- Transformation services encompass turnaround management, M&A strategy, and exit strategy.

Virtual CFOs are instrumental in providing specialized financial expertise and tailored strategic advisory services to meet the specific needs of a business. Their diverse roles include formulating comprehensive financial strategies, conducting in-depth system analyses, optimizing operational processes, addressing intricate cash flow challenges, and devising expansion strategies. In addition, virtual CFOs foster collaborative relationships between the finance department and other business functions, drawing upon their extensive experience in senior corporate finance positions to elevate performance, create value through meticulous planning, and enhance overall efficiency. These multifaceted contributions are essential for driving the long-term sustainability and growth of the business.

Why Choose Us?

Cross-Functional Catalyst Approach

Tailor Made Solutions

Business Partner Role

Execution Guidance

“Without strategy, execution is aimless. Without execution, strategy is useless.” Most organizations fail in execution. The entire organization needs to apply a similar scientific approach to what operational excellence has brought to the operations.

What are the benefits of Virtual CFO service?

Forecasting, Planning, and Reporting

Plan

- Strategic Planning

- Business Planning

- Budgeting, Forecasting, and Sensitivity Analysis

- Bank Borrowing Advisory

- Investor Readiness / Attraction

- Private Equity Growth Equity, Mezzanine Financing

Execute

- Profit Maximization

- Cash Flow and Working Capital Management

- Management Reporting and Executive Dashboard

- Financial Analytics

Measure and Manage

- Enterprise Performance Management

- FP&A Team Organization

Transform

- Turnaround Management

- M&A Strategy

- Exit Strategy

Performance-Focused Approach

Financial Foundation

- Working Capital Management

- Fixed Asset Optimization

- Capital Budgeting

- Cash Flow Planning

- Exit and Divestment

Bottom Line Targeting

- Sourcing and procurement opportunities

- Operations efficiencies

- Overhead Cost Reduction

Top-line (Core Business Focus)

- Sales Force Effectiveness

- Key Account Management

- Customer and Pricing Strategy

- Product Bundling and cross-selling

Top-line (Expansion opportunities)

- Service Innovation

- Market Expansion

- Business Model Innovation

- M&A Strategy

Intrinsic Value Creation Plan

Financial Value Drivers

- Revenue growth

- Return on Capital (ROIC)

- Cost of Capital (WACC)

Short-term Value Drivers

- Sales Productivity

- Operating Cost Productivity

- Capital Productivity

Medium-Term Value Drivers

- Commercial Excellence

- Cost and Organization Structure

- Asset and Capital Efficiency

Long-Term Value Drivers

- Strategic Planning

- Core Business Growth

- Growth Opportunities to Adjacency

- Futuristic Organization Structure

How Does it Work?

Fintelligence Consultants have developed a robust Framework for Planning, Executing, Measuring, Managing, and Transforming the finance function.

Plan

- Strategic planning involves setting goals, evaluating market conditions, and allocating resources for long- term success, a task in which the virtual CFO plays a crucial role.

- Business planning encompasses creating a roadmap for achieving objectives and mitigating risks.

- Budgeting and forecasting prepare an organization’s financial future.

- Bank borrowing advisory services help obtain financing.

- Investor readiness prepares a business for external investment.

- Private equity and mezzanine financing provide capital for business expansion and growth.

Execute

- Profit maximization strategies entail fine-tuning pricing strategies, optimizing operational processes, and harnessing economies of scale for sustainable growth.

- Cash flow and working capital management are pivotal for maintaining financial health and stability and ensuring a robust pool of liquid assets.

- Financial analytics harnesses advanced data analysis to rigorously assess performance and extract invaluable insights.

- Enterprise performance management involves strategic planning and continuous monitoring to enhance organizational performance.

Measure and Manage

- Management Reporting and Executive Dashboard of key performance indicators, leading and lagging indicators, and other critical information to support executive decision-making.

- Establishing robust reporting, providing valuable insights into the organization’s operational and financial performance.

- FP&A Team Organization strategically structures and manages to ensure strong support for decision-making and strategic planning.

- Defining roles and responsibilities and fostering a collaborative and high- performing team environment are imperative for organizational success.

Transform

- Turnaround Management is an assertive strategic process that comprehensively revitalizes and restructures struggling businesses to restore financial stability and profitability.

- Turnaround prioritizes liquidity & stability, cost optimization & efficiency in short term. Enabling the organization to seek growth opportunities followed by a profit maximization plan in the medium term.

- M&A Strategy provides unwavering guidance and support to achieve strategic objectives.

- Exit Strategy involves developing unwavering plans for the orderly and profitable exit of stakeholders from a business.

Coaching and Competence Focus

Our unwavering focus on coaching and developing competence underscores our commitment to helping our clients achieve sustainable business results. We believe that meticulous execution and an unyielding dedication to improvement are paramount. We offer comprehensive supportive services to ensure our clients thrive, including personalized business coaching, tailored competency development, hands-on project and process support, adequate tool support, and customized mentoring. We aim to empower our clients to attain and maintain their desired outcomes, ensuring their long-term success and prosperity.

We have developed a module that considers business needs and executive working styles.

- We begin with Fundamental training in Budgeting and Forecasting, Profit opportunities, Cash flow and Working Capital, Re-Investment strategy, or capital budgeting. We measure and monitor performance management through Financial Analysis and Reporting and meet Board and management expectations.

- We added the necessary competency-building workshop, which included preparing internal policy and controls and understanding risk mitigations. All this leads to the basic foundation of governance. Thinking through the broader perspective of internal accountability and meeting external challenges is a valued competency.

- We offer tools to use, improve, and apply for regular analysis and insights. Many times, different companies have specific requirements. We can guide your team in developing those tools. Tools built in Excel are an excellent beginning. Once the understanding and processes reach proficiency levels, automation, and software systems can enhance their value.

- During the assignment, we encourage your team to take some initiatives and projects under our supervision. That will be an excellent chance to showcase and apply their recently enhanced competence to the company's requirements. We review their performance and guide them toward continuous improvement.

- We wish to take key personnel mentoring. We hope what we deliver to clients will be sustainable in the medium to long term. Many times, mentoring key personnel helps keep that momentum. We identify them as super users. Super users are responsible for mastering specific skill sets and internally training others. This is the benchmark practice where the company can internalize the competence building without frequently hiring an external advisor.

How Do We Serve Our Clients?

Frequently Asked Questions

Fintelligence Virtual CFO offers comprehensive Financial Planning and Analysis (FP&A) services that serve as a valuable business partner, providing guidance and strategic direction to business leaders. Their primary responsibilities include maximizing Business Unit profitability and effectively managing cash flow. The primary objective is to establish a financial strategy seamlessly aligned with the overall business strategy, ensuring the guidance of business leaders, sustained profitability, and adept cash flow management. Furthermore, these services play a pivotal role in devising a strategic business plan, budgeting, and forecasting, which involve critical component assessment and performance monitoring.

Fintelligence Virtual CFO offers various financial planning and analysis services tailored to your business strategy. These services help improve performance and create value through meticulous planning and increased efficiency, resulting in enhanced competitiveness and long-term sustainability for your business.

The services offered include:

- Business partner, providing guidance and strategic support to business leaders, focusing on Business Unit profitability and Cash Flow.

- Profit Maximization by enhancing profitability, attracting investors, and increasing enterprise value.

- Improving the Working Capital and Cash Conversion Cycle to ensure short-term and long-term viability, recognizing the importance of liquidity in raising funding.

- Fundraising advisory services, investor attraction, private equity growth equity, and mezzanine financing.

- Bank Fundraising advisory, offering guidance and planning for securing adequate funding through bank borrowing, which is crucial for business success and enables expansion, innovation, and growth opportunities.

- Performance Management by implementing measurement and management strategies to cover enterprise performance management, Board Management, Reporting, and FP&A team organization.

- Corporate Governance, assisting in establishing effective corporate governance and improving management execution capabilities.

- Providing transformation services, including turnaround management, M&A, and exit strategy.

Fintelligence Virtual CFO offers financial planning and analysis services that align with your business strategy, enhance performance, and create value through careful planning and improved efficiency. The services include business partnering, profit maximization, working capital management, fundraising advisory, bank borrowing advisory, performance management, corporate governance, and transformation services.

You may be surprised to learn that a small business CFO won’t cost you an arm and a leg as long as you outsource them. A Virtual CFO works as a part-time CFO who provides the services of a financial expert and high-quality financial assistance. Small businesses get access to a complete FP&A portfolio that includes working capital management, profit maximization, bank fundraising advisory, budgeting, and performance management.

- Liquidity stabilization is the most crucial part. It has now surpassed profitability measurement in various private investment strategies.

- Improving the Working Capital and Cash Conversion Cycle to ensure short-term and long-term viability, recognizing the importance of liquidity in raising funding.

- Fundraising advisory services, investor attraction, private equity growth equity, and mezzanine financing.

- Bank Fundraising advisory, offering guidance and planning for securing adequate funding through bank borrowing, which is crucial for business success and enables expansion, innovation, and growth opportunities.